How To Pay Off Credit Card Debt (Without Feeling Overwhelmed)

Credit card debt can feel overwhelming, but many people have faced it head-on and come out on top. In this article, we’ll cover the best ways to pay off credit card debt, common mistakes to avoid, and whether consolidation or refinancing makes sense for you.

Find out How Much You Owe

You’d be surprised how many people try to pay off their credit cards without ever truly knowing the extent of their debt. Credit card companies love this because it means you’re operating on autopilot, sending them money without fully grasping how much of your payment is getting eaten up by interest.

It’s time to take back control. To find out just how much you owe, start by logging into your credit card accounts and listing each card’s total balance, annual percentage rate (APR), and minimum monthly payment in a simple spreadsheet. For example:

Seeing the full picture is a game-changer because it gives you clarity on your financial reality and sets the stage for the debt-busting strategies we’re about to discuss.

Want to pay off your debt as fast as possible? Use this Debt Payoff Calculator to see how long it’ll take to become debt-free.

Decide What to Pay off First

Not all credit card debt is created equal. Some cards charge higher interest than others, which affects how quickly your debt grows and what you should focus on first.

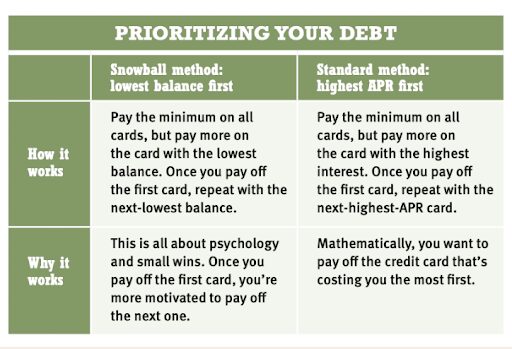

One method is to pay the minimum on all your cards while putting extra money toward the card with the highest APR. This is the most mathematically efficient way to pay off debt, since it reduces the amount you pay in interest over time.

Another approach is the Dave Ramsey debt snowball method, where you prioritize paying off the card with the lowest balance first while making minimum payments on the others. This method is a source of fierce debate in credit card circles. While not the most cost-effective strategy, it can be motivating to see progress quickly, which helps keep you on track.

My expert tip: don’t spend more than five minutes deciding which method to use. Just pick one and do it. The goal is not to optimize your payoff method but to get started paying off your debt.

Negotiate Your APR Down

Let’s talk about putting money back where it belongs: in your pocket. Many people don’t realize they can call their credit card company and ask for a lower interest rate.

If making that call feels intimidating, I’ve put together a simple word-for-word script to help you, free of charge:

YOU: “Hi, I’m going to be paying off my credit card debt more aggressively beginning next week, and I’d like to lower my credit card’s interest rate.”

CC REP: “Uh, why?”

YOU: “I’ve decided to be more aggressive about paying off my debt, and that’s why I’d like to lower the interest rate I’m paying. Other cards are offering me rates at half what you’re offering. Can you lower my rate by 50% or only 40%?”

CC REP: “Hmmm… After reviewing your account, I’m afraid we can’t offer you a lower interest rate.”

YOU: “As I mentioned before, other credit cards are offering me 0% introductory rates for 12 months, as well as APRs that are half what you’re offering. I’ve been a customer for XX years and I’d prefer not to switch my balance over to a lower-interest card. Can you match the other credit card rates, or can you at least go any lower?”

CC REP: “I see… Hmm, let me pull something up here. Fortunately, the system is suddenly letting me offer you a reduced APR. That is effective immediately.”

This simple five-minute conversation could save you thousands of dollars in interest. Simply rinse and repeat this script with all your credit cards.

3 Mistakes to Avoid When Paying off Credit Cards

Don’t overcomplicate your repayment strategy. To keep things simple and effective, here are some common mistakes to make sure you successfully pay off that credit card debt:

1. Only making the minimum repayments

One of the worst mistakes you can make is paying only the minimum each month. This keeps you trapped in debt for years while interest keeps piling up.

Take Erik’s story from my podcast, for example. Growing up, his financial habits made him comfortable with getting by on the minimum. While Erik’s faith in his ability to “figure it out” is admirable, relying solely on minimum payments keeps you stuck in a cycle of debt:

[00:28:00] Ramit: Would you describe your family as poor?

[00:28:03] Erik: Yeah, growing up. And I had a job out of college that was a little bit feast or famine. When I had good months, I lived well.

[00:28:13] Ramit: What’d you do?

[00:28:14] Erik: Oh yeah. I would go out with my friends. I would eat wherever I wanted. I like nice things. So I’d buy a new pair of shoes or spend a pair of jeans, or when I had it, I would spend it, and then months I didn’t have it, I was like, I was okay with that too, because I just knew those months, I was eating ramen that month. I like ramen.

[00:28:36] Ramit: Are you okay to do feast or famine now?

[00:28:41] Erik: No, I’m not.

Erik’s story highlights the emotional and behavioral traps of living paycheck to paycheck while making only minimum payments. It’s easy to just tell yourself that things will always work out, but that mindset keeps you stuck in debt.

2. Keeping the same habits

The definition of insanity is doing the same thing over and over again and expecting different results. Well, that holds true for your financial habits, too. If you don’t change your financial habits, your debt will keep coming back, just like this couple from my podcast who had $4,600 in debt but were still spending $600 a month on GrubHub.

Many people carry subconscious beliefs about money from childhood—whether it’s thinking that “things will always work out,” like Erik from the transcript above, or feeling pressure to keep up with others by spending on things they don’t really need. Take a look at your childhood. What invisible money scripts do you have?

These beliefs about money are costing you. They affect how you speak, think, and act about money— which means that in order to break your bad habits, you need to change your mindset.

3. Falling for quick fixes

You might have heard that balance transfers are a good way to escape high-interest credit card debt. They can sound tempting, offering you a lifebuoy in the form of a lower APR for a few months. However, credit card companies are like magicians: They’ll lure you in with the promise of saving money, only to hit you with a pile of confusing terms and conditions. After a while, you might be stuck in the very same situation you were in before, with possibly more debt to pay off.

Balance transfers can work for some folks. However, I’m not exactly their number one fan. Sure, it might buy you some time, but it doesn’t change the fundamental problem. Consider Ron and Cristina’s situation from my podcast:

[00:06:55] Ramit: I’m going to go out on a limb here. Ron, can I guess that you absolutely hate debt?

[00:07:02] Ron: Absolutely.

[00:07:03] Ramit: So how long is it going to take you to pay it off?

[00:07:06] Cristina: My plan is to pay off aggressively within a year or two if we find a way to make some money, some extra money that we get, since we both are–

[00:07:16] Ramit: Yeah, I got a way. It’s sitting in your garage.

[00:07:22] Ron: Is it smart to do balance transfers from one credit card to another to get out of like the interest to a 0%, even though you have to pay a little bit to do it, or are giving money away at that point still?

[00:07:40] Ramit: It’s a good question. Balance transfers can be okay. They can save people a lot of money, but I will tell you that I often find people in credit card debt will do everything except making a plan to actually pay off their credit card debt. They use balance transfers as a gimmick.

Balance transfers might seem like an easy way out, but they’re often just a temporary bandage on a deeper issue. Many people use them to shuffle debt around instead of tackling the root cause—overspending and the lack of a clear repayment strategy.

Should You Consolidate Your Credit Card Debt?

If you’re juggling multiple credit card balances, debt consolidation might seem like an attractive solution. Instead of managing multiple due dates and interest rates, you combine everything into one payment—usually with a lower interest rate. But while debt consolidation can make repayment easier, it’s not the right choice for everyone.

How debt consolidation works

Debt consolidation works by taking out a new loan or credit line to pay off your existing balances. Some of the most common options include balance transfer credit cards, personal loans, or even home equity loans if you own a home.

A balance transfer card, for example, might offer a 0% introductory APR for a set period, allowing you to pay down your debt without interest. A personal loan can also be useful, providing a fixed interest rate and structured repayment plan. If you own a home, tapping into your equity could offer a lower interest rate, though it comes with the risk of putting your property on the line.

While it doesn’t reduce your overall debt, creating a predictable monthly payment schedule can help you feel more in control. Some consolidation loans may offer lower interest rates than credit cards, but eligibility depends on your credit score and financial history.

When debt consolidation makes sense

Debt consolidation can be a good idea if:

- You qualify for a lower interest rate than the rates on your current credit cards.

- You’re committed to not racking up new credit card debt after consolidating.

- Your credit score is strong enough to get favorable loan terms.

- You want the simplicity of a single monthly payment instead of managing multiple balances.

If you’re disciplined about making regular payments and avoiding new debt, consolidation can speed up your payoff timeline and save you money on interest.

When debt consolidation might not be the best choice

While consolidation can be helpful, it’s not a magic fix. It won’t eliminate your debt—it just reorganizes it. If you don’t address the spending habits that got you into debt in the first place, you could end up in even more trouble.

You might want to think twice about debt consolidation if:

- You have a history of overspending, and access to paid-off credit cards could tempt you to charge them up again.

- You don’t qualify for a significantly lower interest rate, making consolidation less beneficial.

- You’re close to paying off your debt already, so a new loan might not be worth the hassle.

Before consolidating, crunch the numbers: compare the total costs, including any balance transfer fees, origination fees, and how long it will take to pay off the new loan. If the numbers make sense and you’re confident you won’t fall back into debt, consolidation can be a great tool to regain control of your finances.

These articles are a good place to start if you think you need to balance your budget or focus on spending habits first: Money Dials: How You Spend & Why (Expert advice on spending), and Conscious Spending Basics (a guide to achieving your Rich Life). However, if you’ve tried and failed to manage your debt in the past, consider seeking guidance from a financial advisor or credit counselor before consolidating.

Should You Refinance Your Debt?

Refinancing debt is another strategy that can make repayment more manageable, especially if you can secure a lower interest rate. But just like with debt consolidation, it’s important to weigh the pros and cons before moving forward.

How debt refinancing works

Debt refinancing involves replacing an existing debt with a new loan that ideally has better terms—such as a lower interest rate, reduced monthly payment, or a different repayment timeline. This strategy is often used for credit cards, personal loans, auto loans, and even mortgages.

Here’s how it works:

- You apply for a new loan or credit product with better terms than your current debt.

- If approved, the new lender pays off your existing balance.

- You now make payments on the new loan, typically with improved conditions that save you money or make repayment easier.

When refinancing makes sense

Refinancing can be a smart move if:

- You can get a significantly lower interest rate.

- You need lower monthly payments. Extending your repayment term can reduce your monthly payment, making it easier to manage cash flow (though this may mean paying more interest over time).

- Your credit score has improved, making you eligible for better loan terms.

- You want to switch from variable to fixed interest to provide stability and predictability.

When refinancing might not be worth it

While refinancing can save you money, it’s not always the best choice. You should think twice if:

- You have to pay high fees to refinance. Some loans come with origination fees, prepayment penalties, or other costs that could offset the savings. If you have federal student loans, for example, refinancing them into a private loan may cause you to lose eligibility for income-driven repayment plans or loan forgiveness programs.

- You’ll end up paying more interest over time. Extending your repayment period lowers your monthly payments but might result in paying more interest in the long run.

- You’re at risk of racking up new debt.

Before refinancing, carefully compare lenders, loan terms, and any fees involved. Some government-backed programs, for example, such as debt relief initiatives, provide lower interest rates or other financial assistance that may be forfeited if you refinance.

If the numbers work in your favor and align with your financial goals, refinancing could be a smart way to reduce costs and make debt repayment more manageable.

If you’re still struggling or need more tips with your finances, check out my New York Times bestseller, I Will Teach You to Be Rich.

How to Avoid Falling Back into Debt

Paying off credit card debt is a huge accomplishment, but staying debt free is an entirely different challenge. Many people feel a sense of relief after making their final payment, only to find themselves slipping back into old spending habits.

To break the cycle, you need systems in place that prevent debt from creeping back in. Here are a few practical strategies to help you maintain financial stability long after your credit card balances hit zero:

Build an emergency fund

One of the biggest reasons people fall back into debt is not having an emergency fund. Without savings, any unexpected expense—like a car repair, medical bill, or home maintenance issue—can force you to rely on credit cards again. The best way to avoid this is by setting aside money specifically for emergencies.

Start small if you need to. Even $500 to $1,000 in a high-yield savings account can act as a financial buffer and keep you from reaching for your credit card in a crisis. To make saving effortless, automate a small transfer from your checking account each payday. Over time, aim to build three to six months’ worth of expenses in your emergency fund so you’ll be prepared for life’s surprises without falling back into debt.

Set up automatic bill payments

Late fees and missed payments can put you right back into financial stress, especially if you’re hit with penalty APRs that increase your interest rate. The easiest way to avoid this? Automate your bill payments.

To start, set up automatic payments for at least the minimum balance due on your credit cards and other bills. That way, you’ll never miss a due date. Ideally, you’ll want to schedule an extra payment, such as a fixed amount on payday, to reduce your debt faster without feeling the pinch.

It’s also a good idea to set calendar reminders a few days before your bills are due. This gives you time to review your balances, catch any unexpected charges, and adjust your budget if needed.

Switch to cash or debit

If credit cards were your downfall before, consider switching to cash or debit for everyday expenses. The simple act of physically handing over cash (or seeing a debit balance decrease) creates a stronger awareness of spending compared to swiping a credit card.

For those who prefer a structured approach, a cash envelope system can be a great way to control spending. Designate envelopes for different categories (groceries, dining out, entertainment, etc.) and only spend what’s inside. Once an envelope is empty, that’s it for the month.

If carrying cash isn’t practical, a prepaid debit card can be another option. You load it with a set amount, ensuring you only spend what you’ve budgeted.

Review your credit card statements weekly

Many people don’t realize how small, recurring charges add up over time. Subscriptions, convenience fees, and impulse purchases can slowly drain your budget without you noticing. That’s why checking your credit card statements weekly, not just monthly, is a smart habit to develop.

A quick five-minute review each week helps you spot unnecessary expenses before they pile up. Maybe you’re still paying for three different streaming services but only use one, or you’ve been hit with an unexpected fee. Catching these early means you can cancel, dispute, or adjust your spending before it becomes a problem.

Have an accountability partner

Making financial changes alone can be tough, but having someone to check in with can keep you on track. Find a friend, spouse, or financial community to serve as an accountability partner. This doesn’t mean sharing every financial detail—just having someone to discuss money goals with can be a powerful motivator.

A great way to do this is by setting up a monthly “money check-in.” Review your progress, discuss any struggles, and celebrate wins together. Knowing that someone else is tracking their finances with you can make it easier to stick to your goals and avoid falling into old habits.

How Side Hustles Can Speed up Debt Payoff

Paying off debt isn’t just about cutting back on expenses; it’s also about increasing your income. While budgeting and reducing spending help, bringing in extra cash can significantly speed up the process by reducing interest payments and shortening the overall repayment timeline.

Even an additional $200 to $500 per month can make a noticeable difference, allowing you to make larger payments, avoid accumulating more interest, and gain financial freedom sooner.

Types of side hustles to consider

There are countless ways to earn additional income, and the best side hustle for you will depend on your skills, availability, and interests.

Freelancing in areas like writing, graphic design, or programming can provide flexible, high-paying opportunities. If you prefer a hands-on approach, rideshare driving, food delivery, or pet sitting can fit around your main job.

Selling handmade or vintage items, reselling thrift store finds, or renting out a spare room on platforms like Airbnb are also potential income sources. Even small-scale options, like online surveys or cash-back apps, can add up over time when used strategically.

Balancing a side hustle without burnout

While a side hustle can be a powerful tool for debt payoff, balance is essential. Overloading yourself with too many extra hours can lead to burnout, negatively impacting both your physical and mental well-being.

Choose a side hustle that fits your lifestyle and doesn't feel overwhelming. If possible, opt for work that aligns with your interests or skills so that it feels more engaging than exhausting. The goal is to use your side hustle strategically, not to run yourself into the ground.

When to Seek Professional Help

Sometimes, debt situations become too overwhelming to handle alone, and seeking outside guidance is the best step forward. If your debt feels unmanageable despite cutting expenses and increasing income, professional help can provide clarity and a structured plan for repayment.

Credit counseling and structured repayment plans

Non-profit credit counseling agencies offer free or low-cost services to help individuals regain control over their finances. Organizations like the National Foundation for Credit Counseling (NFCC) and Money Management International (MMI) assist with budgeting, financial education, and the creation of structured repayment plans.

For those struggling with high-interest credit card debt, a debt management plan (DMP) could be a helpful solution. These plans consolidate multiple credit card payments into one and often come with lower interest rates, making repayment more manageable.

Avoiding debt relief scams

Any company that charges high upfront fees, guarantees quick debt forgiveness, or advises you to stop making payments should be avoided. Scammers often make unrealistic promises that sound too good to be true, and falling for their tactics can leave you in an even worse financial position.

To stay safe, it’s usually best to work with a reputable non-profit credit counseling agency rather than for-profit debt relief companies.