How Does Inflation Affect Savings (+ What You Can Do About It)

Inflation silently reduces your money's purchasing power over time, making your savings worth less with each passing year. A dollar today will buy significantly less in the future, which means your saved money gradually loses real value.

How Does Inflation Work

Inflation makes everything more expensive over time. The government tracks inflation through the Consumer Price Index (CPI), which monitors the cost of items we buy regularly.

Over the years, the average inflation rate in the US stays around 2-3% annually. This might sound small, but it adds up quickly. At just 3% inflation, the cost of everything doubles in about 24 years.

Several things can cause prices to rise:

- Too much money in the economy chases too few products, pushing prices higher as people compete to buy limited goods.

- Companies face higher costs for materials, labor, or transportation and pass these increases to customers.

- Government policies like printing more money or changing interest rates can trigger inflation across the economy.

- Supply chain problems limit available products, causing prices to jump when demand stays the same.

We all experience inflation differently based on our spending habits. A person who drives a lot feels gas prices increase more strongly. Someone renting an apartment notices housing inflation more than others. Parents with growing kids feel clothing and food inflation intensely.

The tricky part about inflation is how sneaky it becomes over time. Your bank account balance stays the same or grows slightly with interest, but its real buying power silently shrinks.

The Silent Wealth Killer: Inflation's Impact on Your Savings

Inflation silently drains your savings while your account balance looks the same. This financial illusion makes it one of the biggest threats to long-term wealth.

How inflation erodes purchasing power

Your money's purchasing power is what it can actually buy in the real world. Inflation chips away at this power year after year without changing your account balance.

If inflation hits 3% this year, the $100 grocery trip you make today will cost $103 next year for the exact same items. Your bank statement won't show this decline, but your wallet feels it every time you shop.

The effect becomes dramatic over time. Something that cost $10,000 in 1980 would cost over $35,000 today. That's the compounding effect of inflation at work, slowly turning your dollars into dimes without touching your account.

Take a look at the disappearing coffee budget

In 2000, a good cup of coffee cost about $1.25. By 2010, that same quality coffee jumped to around $2.50. Today, you might pay $4.50 or more.

Someone who saved $500 for "coffee money" in 2000 could buy 400 cups back then. That same $500 today buys only about 111 cups. The bank account still shows $500, but its real value has vanished.

Why your bank account is losing money

Most savings accounts pay interest rates below 0.5%, while inflation usually runs at 2-3% or higher. This creates a negative "real return" where your money grows more slowly than prices increase.

Your $1,000 might grow to $1,005 after a year in a typical bank account. But that $1,005 buys less than $1,000 did last year. You're going backward while thinking you're moving forward.

Bank accounts feel safe because the numbers never drop. Your bank statement never shows "Your money lost 2.5% of its purchasing power this year." The balance might even grow slightly, creating a false sense of progress while inflation eats away your savings' true value.

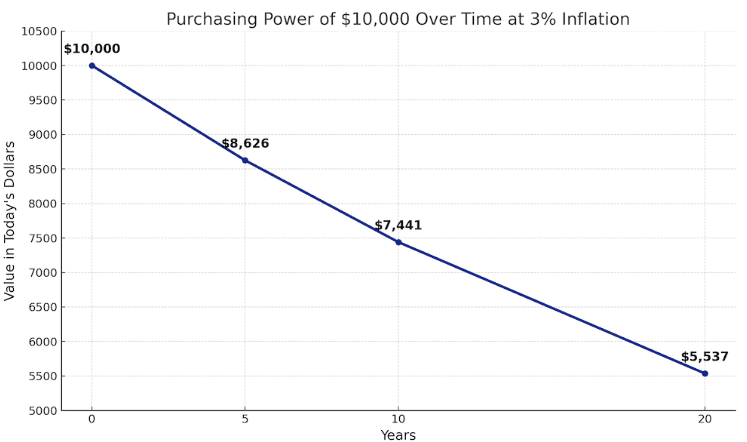

The real value of $10,000 after 5, 10, and 20 years of inflation

At 3% annual inflation, $10,000 today will only have the purchasing power of about $8,626 after 5 years. You've lost nearly $1,400 in buying power without spending a penny.

After 10 years, that same $10,000 would only buy what $7,441 buys today. That's over 25% of your money's value gone.

Over 20 years, your $10,000 effectively shrinks to just $5,537 in today's purchasing power. Nearly half its value disappears, even though your bank statement still shows $10,000 (or slightly more with minimal interest).

Even at a modest 2% inflation rate, $10,000 will lose about one-third of its buying power over 20 years. During periods of higher inflation like we saw in 2022 (7-9%), the erosion happens much faster, with your savings losing 7-9% of its value in a single year.

Why traditional savings accounts can't keep up

The Federal Reserve often keeps interest rates low to boost economic growth. This means banks have little reason to offer higher returns on savings accounts.

Online banks and credit unions typically offer better rates than brick-and-mortar banks, but even their best rates rarely match or beat inflation. Banks simply don't need to pay more since they attract enough deposits even with minimal returns.

The safest financial products usually offer the lowest returns. This creates a tough choice between keeping your money completely secure and watching inflation slowly drain its value. Emergency funds need this security, but your long-term savings require stronger protection against inflation's constant pressure.

Signs Your Savings Strategy Isn't Inflation-Proof

Inflation quietly undermines even the most disciplined savers when they rely on traditional methods. Recognizing these warning signs can prevent years of invisible wealth erosion.

Your money sits in basic savings accounts

Most of your savings probably live in accounts paying less than 1% interest, which means you're actively losing ground to inflation with every passing month. Many major banks currently offer as little as 0.01% interest on savings accounts while inflation soars much higher, creating a significant gap that widens each year.

Even accounts marketed as "high interest" at traditional banks typically pay rates well below the current inflation rate. This creates an illusion of safety while your money's purchasing power steadily declines.

The situation becomes worse the longer your funds remain in these low-yield accounts, as inflation compounds year after year, accelerating the erosion of your hard-earned savings.

Your interest rates are below inflation rates

The next time you receive a bank statement, compare your interest rate against the current inflation rate. If your rate falls short (which it almost certainly does), your purchasing power diminishes despite the growing balance. High-yield savings accounts from online banks typically offer rates 10-15 times higher than traditional banks, but even these enhanced rates often trail behind inflation's relentless march.

Certificates of deposit might seem like an improvement since they lock in slightly higher rates, but they frequently deliver below-inflation returns while restricting access to your money.

You haven't adjusted your savings goals for inflation

Setting target savings amounts without accounting for future inflation virtually guarantees your savings will fall short of your actual needs. A $40,000 car today might cost $53,000 in ten years with 3% inflation, meaning your savings target must reflect this reality rather than today's prices.

Many people establish arbitrary savings goals like "$100,000 for retirement" without considering what that money will actually purchase when they need to spend it. This approach leads to a false sense of security as you hit numerical targets that represent inadequate purchasing power for your future needs. Without inflation adjustments, your savings goals become moving targets that drift further away even as you appear to move closer.

Your retirement calculations ignore inflation impacts

Standard retirement calculators often ask how much annual income you'll need without clarifying whether that figure represents today's dollars or future purchasing power. If you require $50,000 annually for expenses today, you'll need approximately $90,500 annually in 20 years (assuming 3% inflation) just to maintain your current lifestyle.

While Social Security benefits include cost-of-living adjustments, these adjustments frequently underestimate real-world inflation, especially for healthcare expenses that tend to rise faster than general inflation.

Traditional retirement planning rules like the 4% withdrawal guideline may require significant modification during periods of elevated inflation, as they were developed during times of more moderate price increases and different economic conditions.

How Different Types of Savings Are Affected by Inflation

Inflation impacts various savings types differently, with some far more vulnerable than others.

Emergency funds and cash reserves

Emergency funds exist for immediate access during unexpected situations, which means they typically sit in low-yield accounts where inflation hits hardest. The safety and liquidity these accounts provide comes at the cost of your money's purchasing power.

The standard advice of keeping 3-6 months of expenses in emergency savings makes sense for financial security, but creates a dilemma when it comes to inflation protection. Here's how inflation affects this critical money:

- Your emergency fund loses about 2-3% of its buying power annually in normal times, and much more during high inflation periods like 2022.

- A $10,000 emergency fund set aside five years ago would buy roughly what $8,600 buys today, despite showing the same balance on your statement.

- Your safety net effectively shrinks every year unless you regularly add more money to maintain its real-world value.

Finding the right balance is tricky but essential. Consider keeping 1-2 months of expenses in a checking account for immediate needs, then placing the rest in higher-yield but still liquid options like money market accounts or high-yield savings accounts.

Long-term savings accounts

Money set aside for goals more than 2-3 years away suffers significantly from inflation's compounding effect. The longer your timeline, the more protection your money needs from inflation's constant drain on purchasing power.

Traditional savings vehicles for long-term goals often prioritize safety rather than growth, making them especially vulnerable to inflation erosion. Many people mistakenly use the same type of account for both short and long-term savings, missing opportunities to better shelter their future funds from inflation's effects.

Without growth that outpaces inflation, your long-term savings effectively shrink over time despite your account balance growing slightly with interest.

Certificate of deposits (CDs)

CDs typically offer slightly higher interest rates in exchange for locking up your money for a set period. While this seems like a good trade-off, even 5-year CDs rarely offer rates that beat inflation, meaning your money still loses purchasing power despite being inaccessible.

CD laddering, where you buy CDs with staggered maturity dates, provides some flexibility but doesn't solve the fundamental inflation problem. Your money remains vulnerable to purchasing power erosion regardless of how you structure your CD strategy.

During periods of rising interest rates, long-term CDs can leave your money stuck earning below-market rates for years while new CDs offer much better terms. This creates an opportunity cost on top of inflation's impact, further reducing your money's effective growth.

Retirement savings

Retirement funds feel the full force of inflation's compounding effect since they remain invested for decades. The long time horizon makes inflation protection absolutely critical for maintaining your lifestyle in retirement.

- A retirement that requires $1 million in today's dollars would need about $1.8 million after 20 years of 3% inflation just to buy the same goods and services.

- Traditional pension plans may offer limited or no inflation adjustments, resulting in benefits that buy less each year throughout your retirement.

- Even small inflation differences compound dramatically over 30+ years, potentially cutting your retirement purchasing power in half if not properly addressed.

The retirement savings challenge grows even more complex because you'll likely need your money to last 20-30 years during retirement itself. This means your savings must continue growing enough to offset inflation even while you withdraw funds to live on.

How To Inflation-Proof Your Savings

Fighting inflation requires active strategies that go beyond traditional savings. These approaches help your money maintain its purchasing power over time.

Move cash to high-yield savings accounts

High-yield savings accounts typically offer interest rates 10-15 times higher than traditional banks, though they still often fall below inflation. Online banks like Ally, Marcus, and Capital One usually provide the best rates because they operate with lower overhead costs than physical banks.

Make sure any high-yield account you choose remains FDIC-insured, protecting your deposits up to $250,000 per bank. Switching to these accounts is typically easy and can be completed online in under 30 minutes. You don't even need to close your existing accounts immediately, allowing for a smooth transition.

While high-yield accounts won't completely defeat inflation, they significantly reduce its impact compared to traditional savings accounts and can help grow investments. The difference between earning 0.01% and 3.5% on your emergency fund adds up to hundreds or thousands of dollars annually on larger balances.

Consider money market accounts for better rates

Money market accounts often pay slightly higher interest than regular savings accounts while providing the same FDIC insurance protection. These accounts typically include check-writing abilities and debit cards, making them more flexible than traditional savings options.

Some money market accounts require higher minimum balances, usually between $2,500 and $10,000, to earn the best rates. This makes them ideal for emergency funds or savings you want to keep accessible while earning better returns.

Unlike money market funds, money market accounts are bank products with federal deposit insurance protection.

Invest in inflation-protected securities (TIPS)

Treasury Inflation-Protected Securities (TIPS) are government bonds specifically designed to protect against inflation. The principal value of TIPS increases with inflation and decreases with deflation, as measured by the Consumer Price Index.

TIPS pay interest twice a year at a fixed rate applied to the adjusted principal, so your interest payments grow with inflation too. This double protection makes TIPS one of the most direct ways to shield your money from inflation's effects.

You can buy TIPS directly from the government through TreasuryDirect.gov or through most brokerage accounts. They come in 5-year, 10-year, and 30-year terms, allowing you to match them to different financial goals.

Use I-bonds for medium-term savings

Series I Savings Bonds (I-bonds) are another government-issued security that provides strong inflation protection. I-bonds earn interest through a combination of a fixed rate and an inflation rate that adjusts every six months based on the CPI.

You can purchase up to $10,000 in electronic I-bonds per person per year, plus an additional $5,000 using your tax refund. This limit applies per calendar year, so couples can purchase up to $20,000 annually plus potential tax refund purchases.

I-bonds must be held for at least one year, and cashing them before five years incurs a penalty of three months' interest. This makes them ideal for medium-term goals like saving for a house down payment or major purchases 2-5 years away.

Diversify with stock market investments

The stock market has historically outpaced inflation over long periods, making it a crucial tool for protecting purchasing power. While stocks can be volatile in the short term, their long-term growth potential makes them effective inflation fighters.

Broad-based index funds like those tracking the S&P 500 provide diversified exposure to the stock market with low fees. This approach gives you ownership in hundreds of companies without requiring extensive investment knowledge.

Stock investments work best for money you won't need for at least 5-7 years, as markets can experience significant ups and downs over shorter periods.

Explore dividend-paying stocks for income growth

Dividend-paying stocks often increase their payouts over time, creating an income stream that can keep pace with or exceed inflation. Many companies have histories of raising their dividends annually, helping shareholders maintain purchasing power.

Dividend aristocrats, companies that have increased dividends for at least 25 consecutive years, can be particularly valuable during inflationary periods. These businesses have demonstrated the ability to grow profits even when costs rise.

Reinvesting dividends creates a powerful compounding effect that significantly boosts returns over time. This strategy turns inflation's compounding power against itself, helping your money grow faster than prices increase.

Diversify, diversify, diversify

Different assets respond differently to inflation, creating both risks and opportunities for protecting your money. A thoughtful mix of investments provides better inflation protection than any single approach.

- Consider a balanced portfolio that might include stocks for growth, bonds for stability, real estate for inflation-resistant income, and perhaps a small allocation to commodities that often rise with inflation.

- International investments can provide additional inflation protection, as some economies may handle inflation differently than the US, giving you exposure to various economic environments.

- Regularly rebalance your portfolio to maintain your desired asset allocation as market values change, ensuring you stay on track with your inflation-protection strategy.

The main idea behind diversification isn't just risk reduction but creating a financial ecosystem where different parts of your portfolio thrive under various economic conditions. This approach helps ensure that inflation doesn't undermine your entire financial picture at once.

If you don’t know where to begin, you can check out some of my articles about investing and diversifying your portfolio:

- Investing for Beginners: A Quick and Easy Guide to Investment

- Diversified Investment Portfolios: How To Build One (+ examples)

Common Inflation Protection Mistakes to Avoid

Even with good intentions, many people make counterproductive moves when trying to protect their money from inflation. These mistakes can cost more than inflation itself.

Panic-switching to risky investments

When inflation spikes, some investors desperately move into highly speculative investments hoping for huge returns to offset rising prices. This reaction often leads to worse outcomes than inflation would have caused.

- Cryptocurrencies often attract panic investors during inflation, promising revolutionary returns while actually introducing enormous volatility and risk.

- Get-rich-quick schemes and trendy investments gain popularity precisely when traditional savings feel inadequate against rising prices.

- Penny stocks and highly leveraged options trading can wipe out savings quickly when pursued as inflation hedges by inexperienced investors.

The emotional nature of inflation fears makes rational decision-making difficult. Watching prices rise while your savings appear to shrink creates anxiety that can cloud judgment.

Trying to time the market based on inflation fears

Attempting to move in and out of investments based on inflation predictions rarely succeeds. The financial markets process inflation information quickly and unpredictably, making timing nearly impossible.

Market timing often results in buying high and selling low, exactly opposite of successful investing. Investors frequently exit markets after they've already fallen and return only after they've substantially recovered, missing the most important days for returns.

Consistent investing through different economic cycles typically produces better results than trying to jump in and out based on inflation news.

Ignoring the tax impact of inflation-fighting moves

Some inflation-protection strategies create taxable events that reduce their effectiveness. Without considering taxes, you might end up with less protection than expected.

Interest from savings accounts and most bonds gets taxed as ordinary income, with rates potentially as high as 37% for high earners. This tax bite makes the already-low returns from these investments even less effective against inflation.

Selling investments for a profit triggers capital gains taxes, which must factor into your inflation-protection calculations. Short-term gains face higher tax rates than long-term gains, creating another consideration when reacting to inflation.

Tax-advantaged accounts like 401(k)s and IRAs can shelter your inflation-fighting investments from immediate taxation.

Sacrificing liquidity completely

Some investors lock up too much money in illiquid investments like real estate or long-term CDs while pursuing inflation protection. This approach can backfire when you need cash unexpectedly.

Without sufficient accessible money, you might be forced to sell investments at a loss during emergencies. This scenario often costs far more than the inflation you were trying to avoid in the first place.

Many inflation-protected investments come with tradeoffs regarding access to your money. I-bonds require holding for at least one year, real estate can take months to sell, and some inflation-protected securities have penalties for early withdrawal.

A balanced approach works best, with some liquid assets even if they don't provide optimal inflation protection. This ensures you have cash available for opportunities and emergencies while protecting the bulk of your savings from inflation's long-term effects.

Creating an Inflation-Proof Financial Plan

A successful inflation protection strategy requires thoughtful planning rather than reactive decisions.

Balance immediate needs with inflation protection

Your savings serve different purposes and timeframes, requiring tailored inflation protection strategies. A successful plan addresses both short-term security and long-term purchasing power.

- Divide your money into timeframe buckets: immediate needs (0-1 year), short-term goals (1-3 years), mid-term objectives (3-7 years), and long-term wealth (7+ years).

- Accept some inflation impact on emergency funds in exchange for perfect liquidity and safety, keeping this portion in high-yield savings accounts.

- Use I-bonds, short-term TIPS, or CD ladders for your mid-term bucket, balancing inflation protection with reasonable access.

- Invest more aggressively in assets like index funds and dividend stocks for long-term money, as these have historically beaten inflation over extended periods.

This layered approach ensures your money maintains appropriate protection based on when you'll need it. Your emergency fund stays available while your long-term savings grow enough to offset inflation's erosion.

Adjust your asset allocation for different life stages

Younger people with decades until retirement can afford to be more aggressive in fighting inflation through stock-heavy portfolios. The long time horizon allows for riding out market volatility while capturing growth that typically exceeds inflation.

As you approach retirement, you must balance inflation protection with reducing overall portfolio volatility. Gradual shifts toward more stable investments protect against market downturns while maintaining enough growth to offset inflation's ongoing effects.

During retirement, consider keeping 1-2 years of expenses in cash equivalents, 3-5 years in inflation-protected bonds, and the rest in a diversified portfolio of stocks and other growth investments.

For a more detailed break-down of asset allocation, you can read my article, Asset Allocation by Age (+ Specific Recommendations).

Regularly review and adjust your strategy

Inflation rates change over time, sometimes dramatically, requiring adjustments to your protection strategy. What works during one economic cycle may prove ineffective during another.

- Set calendar reminders to review your savings and investments quarterly or at least annually with inflation specifically in mind.

- Track your real returns (nominal returns minus inflation) rather than just account balances to accurately measure your progress against inflation.

- Stay informed about new inflation-protection tools and products as financial institutions continuously develop offerings in response to economic conditions.

- Remain flexible in your approach, as inflation can come from different sources and affect various asset classes differently depending on the economic environment.

The best inflation protection comes from ongoing attention rather than a one-time fix. And remember that defeating inflation completely isn't realistic or necessary. The goal is minimizing its impact while maintaining financial flexibility and progress toward your goals.