What It Means to Be House Poor + How to Fix It

If most of your income is tied up in housing costs—like your mortgage, utilities, repairs, insurance, and taxes—leaving you little for savings or other essentials, you might be house poor.

Warning Signs You're House Poor (or About to Be)

Being house poor traps you in a paycheck-to-paycheck cycle that can be draining on your financial and mental well-being.

If the below statements are true for you, it’s likely a warning sign that you are house poor.

1. Your housing costs exceed 28% of your monthly gross income

Financial experts have long used the 28% rule as a benchmark for housing affordability.

The 28% rule suggests that your total housing costs should consume no more than 28% of your monthly gross income. This threshold allows enough financial breathing room for savings, other necessities, and spending on things that make life enjoyable.

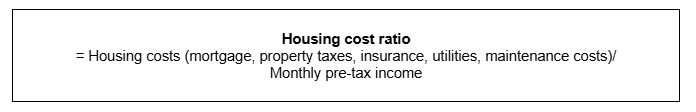

Here’s how to calculate your ratio:

If your housing cost ratio is well above 28%, you may already be house poor or at high risk of becoming so.

Not sure if now is the right time to buy a house? Check out my guide to buying your first home for a step-by-step breakdown before you commit.

Case study: The professor who spends half his income on housing

Shaun is a married college professor from Utah. When a friend offered Shaun and his wife a good price on a home, they decided to purchase it for $189,000. With Shaun’s steady job and a low interest rate on the mortgage, it seemed like a smart move.

But Shaun’s annual income was $44,000, and his wife brought in only $8,000 working part-time. Their mortgage quickly consumed more than half of their take-home pay, pushing them well beyond the safe zone. They had failed to factor in the full costs of homeownership, and as a result, they found themselves house poor. To turn things around, Shaun took these steps:

- Refinanced his home for a lower rate and a higher home appraisal

- Took a side job as a part-time radio DJ for extra income

- Committed to making higher monthly payments to pay off his mortgage in 18 years instead of 30

2. You’re constantly stressed about money

Financial anxiety is your body’s way of telling you that something’s off. If you feel a knot in your stomach every time the bills arrive, lose sleep over money, or find yourself constantly arguing with your partner about housing costs, it’s a clear sign your home may be stretching you too thin.

Shaun felt this strain firsthand: “It’s tough. I look at my paycheck and say, most of this is a wash. It’s already spoken for... Ramit’s not big on owning a home, and I can see why.”

When your paycheck feels gone before it even hits your account, it takes a serious emotional toll. This constant stress is not just unhealthy but also unsustainable.

3. You’ve cut all discretionary spending

There's a profound difference between mindful spending (choosing what matters most to you) and forced deprivation (having no choices at all).

When you find yourself eliminating every small pleasure—the occasional dinner out, modest gifts for loved ones, even small indulgences like streaming services—just to make your housing payment, you're experiencing the reality of being house poor.

Shaun’s family felt this squeeze, even with his wife contributing her part-time income and him juggling a second job. Despite refinancing and trying to pay down the principal faster, their lifestyle had to be stripped to the basics just to stay afloat.

When your home consumes so much of your budget that there is no longer room for anything else, you're not actually building wealth—you’re stuck in survival mode.

The Real Cost of Being House Poor

Being house poor costs you more than just money; it significantly shapes the trajectory of your life.

Your home takes more than it gives

You bought the house because it felt like the next step toward success. But now every time the mortgage payment hits, it brings you immense anxiety and stress.

The home that was meant to offer stability has become the reason you feel financially stuck and emotionally drained.

“Just making it work” doesn’t work forever

Many people convince themselves that their financial situation is only temporary. Once they get a raise or refinance their home, things will be better.

But if 40% to 50% of your income goes to housing, there’s no breathing room. You are no longer working towards financial freedom, but rather scraping by each month just to survive. Over time, this pressure will be draining for both you and your family.

The ripple effect of being house poor impacts your entire life

Being house poor means saying no to dinners out, putting off investments, and feeling a gut-wrenching stress every time a bill arrives. The true cost of being house poor shows up in the stress and sacrifices you face, and the goals you might be forced to set aside.

Your emergency fund will likely become stagnant. Retirement plans are put on hold. Slowly, the life you dreamed that your home would support begins to shrink.

Let’s take a look at Jonathan and Shalom, a young couple who came on our podcast after purchasing a $730,000 home, believing it was the next step toward their dream life. However, the financial strain quickly set in. Jonathan found himself unable to sleep, consumed by anxiety over their mortgage payments.

| [00:07:41] Ramit: All right. That’s a considerable jump. You went from 1,800 a month in rent, which was all in. That’s how much you paid. That was it. To now, 4,500 plus assorted phantom costs that haven’t even really been added. Let’s just say, I don’t know, four, 500 bucks extra a month. Ballpark. That’s a huge jump.

[00:08:03] Shalom: Mm-hmm. [00:08:04] Ramit: More than double. [00:08:06] Jonathan: When I put my head down my pillow at night, it’s like, okay, so even if all the numbers work fine, this seems like there’s this huge liability of the house hanging over my head. It’s just like those things, like flood, there’s mold. I mean, there could be a tornado that hits the house. I mean, and it is one of those things where, um, I feel that weight. |

The home that was meant to offer stability became a source of constant stress, affecting their well-being and their relationship.

Remember: A home should support your dreams, not squeeze the life out of them.

The Most Common Paths to Being House Poor

How do people get to this point in the first place?

Take the example of Shaun and his family. He didn’t get to the point of being house poor by coincidence; like many well-meaning homebuyers, he based his home-purchasing decision on the loan he was qualified for, not on a careful assessment of what he could truly afford.

You can avoid ending up in a similar situation by staying far away from these traps:

1. Buying the most expensive house you qualify for

One of the biggest mistakes first-time homebuyers make is assuming that if the bank approves them for a certain loan amount, it must be affordable. But lenders don’t consider your long-term financial goals, such as investing, saving for your kids’ education, or simply having enough money to enjoy life.

When your mortgage stretches your budget to the limit, you’re left with little room for error. One job loss or unexpected expense could quickly turn your dream home into a financial nightmare.

2. Underestimating the true cost of homeownership

If you’re constantly being caught off guard by hidden costs like property taxes, insurance, maintenance, furnishing, or utilities, it could be a sign that your home is costing more than what you can comfortably afford. To make a well-informed decision, this guide can help you figure out if you can really afford your dream home.

3. Failing to account for life changes

Job shifts, new kids, health issues, or caring for aging parents can all impact your finances in ways you didn’t expect.

If your housing costs are already pushing your limits, even a small change can throw your entire budget off track. When buying a home, it’s smarter to play it safe and leave plenty of breathing room, rather than hoping for the best and assuming that everything will turn out smoothly.

How to Avoid Becoming House Poor

Before you get emotionally attached to hardwood floors or upgraded kitchens, you need a clear system that protects your financial goals and lifestyle, so you won’t be easily swayed by your mortgage lender’s interests:

1. Use the Conscious Spending Plan before you even start house hunting

Banks will often approve you for a mortgage loan that you technically qualify for but can’t actually afford. That’s why it’s essential to use the Conscious Spending Plan first, so that you can stay in control.

Start with your monthly take-home pay and allocate it across four categories:

- Fixed costs (housing should stay under 28%, and all fixed costs under 60%)

- Savings

- Investments

- Guilt-free spending

Shaun from the earlier case study ended up house poor because he jumped on what seemed like a “good deal” without first evaluating how it fit into his Conscious Spending Plan.

This system gives you a clear picture of where your money goes, giving you room to enjoy the life you want, invest in your future, and still afford your home without sacrificing everything else.

2. Calculate the true cost of owning the home

Your mortgage payment is only one part of the equation. To truly know if you can afford a home, do your homework and research these additional costs:

- Property taxes: Research past increases in your area to get a sense of future changes.

- Insurance: Include home coverage and potentially flood or earthquake coverage.

- Utilities: Check typical utility bills in the area based on your family size.

- Repairs: Bring in a contractor to assess the home and provide a repair estimate.

- Homeowner Association (HOA) fees: Check for current dues and any signs of upcoming assessments.

3. Evaluate your Rich Life priorities before you commit

Buying a home is often treated as something you're supposed to do to feel successful. But it’s worth asking: Is this choice truly aligned with the life you want to build?

Before you commit, take time to reflect on your priorities. Maybe you want the freedom to travel or the flexibility to switch careers. Or maybe a spacious home in a great neighborhood really is aligned with your priority of raising your family.

There’s no right or wrong answer, but your spending should reflect your values intentionally, not based on societal pressure. Too many people buy homes because it feels like “the next step,” only to feel stuck later. Ask yourself, “Does this home support the life I want to build in the next five years?”

Common Home Buying Myths That Lead to Being House Poor

Here are a few common myths to watch out for (hint: they often come in the form of well-intentioned advice):

1. “Renting is throwing away money.”

This is one of the most common myths that pushes people into buying before they’re ready.

The truth is that renting isn’t throwing away money at all—you’re using your money to pay for flexibility, stability, and the absence of hidden costs of homeownership.

If you’re still building your savings, investing, or unsure about your long-term plans, or even if the housing market just doesn’t make sense, renting can be the smarter financial move.

2. “Buy the most expensive house you can afford.”

It sounds tempting: your dream home, a “one-time investment,” so why not go all in?

But stretching your budget to the limit means sacrificing your financial flexibility. When most of your income goes toward your home, there’s little left for emergencies, investments, or the ability to simply enjoy life.

By choosing a home that fits comfortably within your means, you give yourself the freedom to enjoy other aspects of life without the stress of mortgage overload.

3. “Real estate always goes up.”

We’ve all heard it: “Real estate is a safe bet.”

But markets can shift unexpectedly, and home values don’t always rise, especially when markets crash. The idea that your home will always appreciate is wishful thinking.

When buying a home, focus on finding one that sustainably fits your needs and lifestyle, treating any future increase in value as a bonus, not a guaranteed investment.

Living Your Rich Life Without Sacrificing Homeownership

By aligning your housing costs with your values and financial goals through the Conscious Spending Plan, you can maintain a balanced life that ensures both financial security and personal enjoyment.

Sometimes, prioritizing other financial goals—like debt repayment or retirement savings—is the smarter move before jumping into homeownership.

The key is making intentional choices that support the life you truly want, not simply succumbing to societal pressures. That way, you avoid becoming house poor and can live the life that truly brings you joy and fulfilment.